[vc_row][vc_column][vc_column_text]E-commerce exploded during the last few months.

Another fresh poll (4,780 respondents) conducted by Blackbox and Toluna’s study, titled “Into the Light: Understanding What Has Changed for the Asean Consumers during Covid-19” highlighted that the average Malaysian consumer ecommerce spending has increased by 33% (Choong , 2020).

Another survey conducted by Bain & Company indicated that 40% of South-east Asia’s consumers have tried a different brand since Covid-19 and 42% are leaning towards more reputable brands (Yendamuri, et al., 2020).[/vc_column_text][vc_single_image image=”5592″ img_size=”full”][vc_column_text]Chart Credit: https://www.bain.com/insights/how-covid-19-is-changing-southeast-asias-consumers/

Both these polls and surveys provide insights that consumer consumption has shifted significantly online.

Addressing these concerns, the key observation from BlackBox and Toluna’s poll is that e-commerce players will be required to up their service level to maintain higher expectations in terms of delivery speed, delivery cost and product pricing.

[/vc_column_text][vc_column_text]Bain’s survey supported the argument that consumers are willing to try new brands for the first time.

[/vc_column_text][vc_column_text]Bain’s survey supported the argument that consumers are willing to try new brands for the first time.

What this means is that we need to continue to drive eyeballs from our digital marketing activities to support top-funnel awareness to drive new customers into our e-commerce initiatives.

While this is important, let us not forget that footfall will happen again.

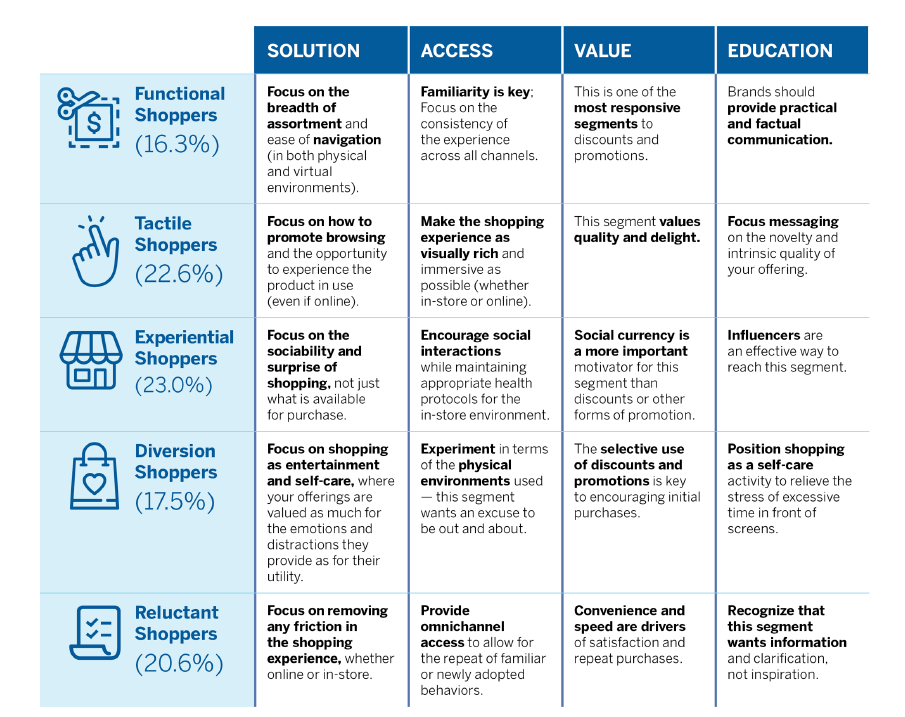

In this article, I will share the insights of 5 types of consumers who will be returning to our stores. Get Ready. This piece is adapted from an MIT Sloan review piece entitled, “As Stores Reopen, Which Customers Are Most Likely to Return?” (Knowles, et al., 2020).

- The Functional Shopper

This group of shoppers dislikes disruptions. They crave for familiarity and therefore the return to normalcy is a welcome respite. Mental notes of aisles and displays play an important role for this shopper’s journey. Taking a cue from this familiarity, they react best with discounts and promotions. From the observation of the study, these shoppers will likely lean toward personal shopper services. Think HappyFresh. - The Tactile Shoppers

Browsing is a critical element to engage with these shoppers. The “feel and touch” experience. They are attracted to strong visual displays. Look at fast fashion providers like H&M and even Sephora. While the pandemic restricted the physical browsing experience, the brands continue to nurture these experiences by enriching their mobile browsing interaction through Instagram feeds which cleverly integrated e-commerce checkouts. - The Experiential Shoppers

This segment tends to focus on the joy of being surprised through a shopping activity. New novelty such as retail closet (Calugar, 2020) whereby exclusive areas have earmarked for a specialist shopping experience. It ranges from special hours dedicated to special age groups or exclusive locations. For example, not all branch outlets may offer flagship services or premium services. - The Diversion Shoppers

These shoppers crave for distractions. After being in lockdown mode, they are likely to try out new things or new experiences to pursue some sort of “revenge shopping” mentality. Weeks or months of webinar fatigue will fuel this impulse and spontaneous purchase behaviours. In the article, they cited Atelier restaurant in Canada producing a compressed menu for an abstract art food experience providing pick up meals limited to only 10 pickups per day. In other observations, our hospitality industry is providing bento-style boxed meals in exchange to the former buffet-style line-up. - The Reluctant Shoppers

They have gone online during this crisis. The switch could be more permanent than ever. To address these shoppers, the omnichannel experience will be required for a frictionless shopping experience. They will browse in-stores and purchase online or vice versa. Convenience and shipping speed are vital as also highlighted in the earlier part of this article on online customer service and delivery options.

Figure 1: Apply the SAVE framework

The returning physical shoppers coupled with stringent health precautions will continue to be top agenda in the coming months. Our ability to address these characteristics offers a realistic opportunity to address any woes. However, what we cannot deny is that digitalisation is no longer an option but rather a norm.

In many stages of digitalisation efforts, focus on the 1st step: how is your digital presence? Be honest and take the necessary steps to address these. As we welcome back our customers, let’s open for business.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

References

Calugar, L., 2020. www.cpexecutive.com. [Online]

Available at: https://www.cpexecutive.com/post/retail-trends-that-will-remodel-the-industry-in-2020-and-beyond/

[Accessed 29 Sept 2020].

Choong , J., 2020. Malaymail. [Online]

Available at: https://www.malaymail.com/news/malaysia/2020/09/24/malaysians-like-using-e-commerce-platforms-but-want-better-service-study-fi/1906051

[Accessed 24 Sept 2020].

Knowles, J., Lynch, P., Baris, R. & Ettenson, R., 2020. MIT Sloan Management Review. [Online]

Available at: https://sloanreview.mit.edu/article/as-stores-reopen-which-customers-are-most-likely-to-return/?og=Home+Series

[Accessed 24 Sept 2020].

Yendamuri, P., Keswakaroon, D. & Lim, G., 2020. bain.com. [Online]

Available at: https://www.bain.com/insights/how-covid-19-is-changing-southeast-asias-consumers/

[Accessed 24 Sept 2020].

[/vc_column_text][/vc_column][/vc_row][vc_row equal_height=”yes” content_placement=”middle”][vc_column width=”1/6″ offset=”vc_hidden-xs”][vc_single_image image=”1715″ style=”vc_box_outline_circle”][/vc_column][vc_column width=”5/6″ offset=”vc_hidden-xs”][vc_column_text]

author

Doh Hau Goh

Goh Doh Hau is in the leadership team of Garganto, a boutique style digital marketing agency and ecommerce builder. He enjoys marrying evidence-based research with observation insights to curate gems of practical information. He is a MBA graduate from Sydney Business School (University of Wollongong)[/vc_column_text][/vc_column][/vc_row][vc_row equal_height=”yes” content_placement=”middle”][vc_column width=”1/6″ offset=”vc_hidden-lg vc_hidden-md vc_hidden-sm”][vc_single_image image=”1715″ alignment=”center” style=”vc_box_outline_circle”][/vc_column][vc_column width=”5/6″ offset=”vc_hidden-lg vc_hidden-md vc_hidden-sm”][vc_column_text]

author

Doh Hau Goh

Goh Doh Hau is in the leadership team of Garganto, a boutique style digital marketing agency and ecommerce builder. He enjoys marrying evidence-based research with observation insights to curate gems of practical information. He is a MBA graduate from Sydney Business School (University of Wollongong)[/vc_column_text][/vc_column][/vc_row]